Product Description

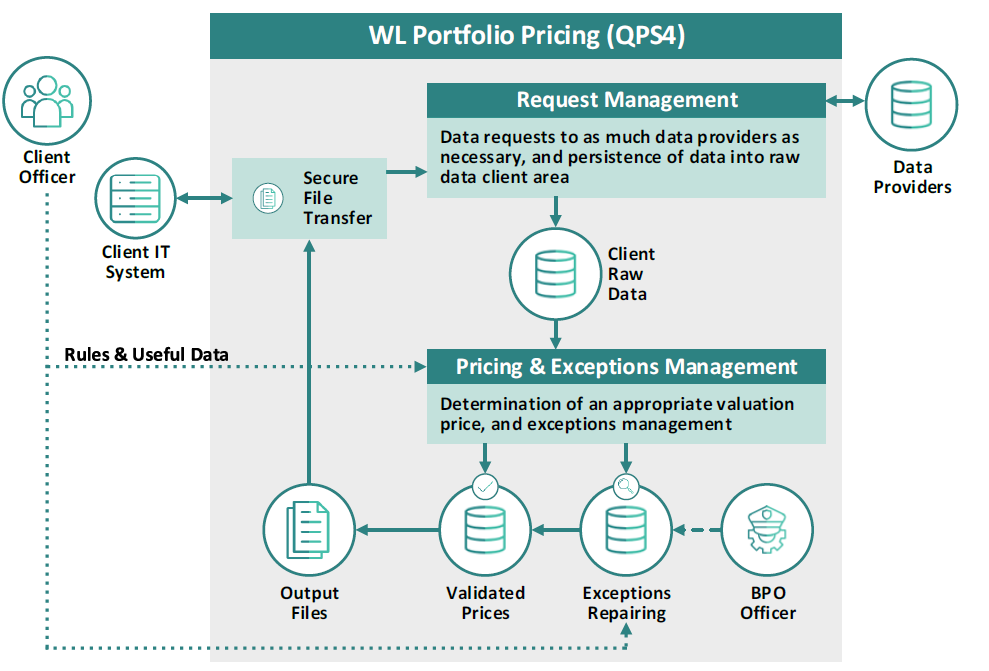

Portfolio Pricing (QPS4) is an advanced pricing service, enabling the daily establishment of an appropriate valuation price (according specific pricing policies or “Fair Value” (IFRS13)) for the portfolio holdings of investment funds or private banking portfolios as well as continuous monitoring thereof. Portfolio Pricing (QPS4) monitors and determines valuation prices on the basis of client-specific. A number of provisions and requirements must be taken into account when valuing the portfolio holdings. The aim should be to ensure the uniform and constant valuation of as many assets as possible. The regulatory framework for e.g. regulated funds includes in particular:

- UCITS IV: European Directive ruling the common standards for Undertakings for Collective Investments in Transferable Securities

- UCITS – EAD: The UCITS Eligible Assets Directive

- IFRS-13: Int’l Financial Reporting Standards

- IAS: Int’l Accounting Standards under the provisions and framework of IFRS. Particularly IAS39 concerning fair value measurement for financial assets.

- KARBV “Kapitalanlage Rechnungslegungs- und Bewertungsverordung”, i.e. the German legislation regarding the accounting and valuation principles applicable to investment vehicles.

On the basis of the above regulatory framework, the following procedure is to be applied when determining the fair value of an asset:

- Markets: assessment and hierarchization of appropriate markets, based on UCITS framework

- Active Market: assess whether or not the instrument is negotiated / traded under the conditions of an active market according to the specifications of IAS39

- Price Levels: assess which price levels are available out of the overall quotations provided by the selected appropriate markets and pricing sources

- Fair Value Price and Market: out of the selected, valid markets and prices, select the fair value price and market for the instrument on a given day.

- Result: the instruments daily fair value of the most appropriate market.

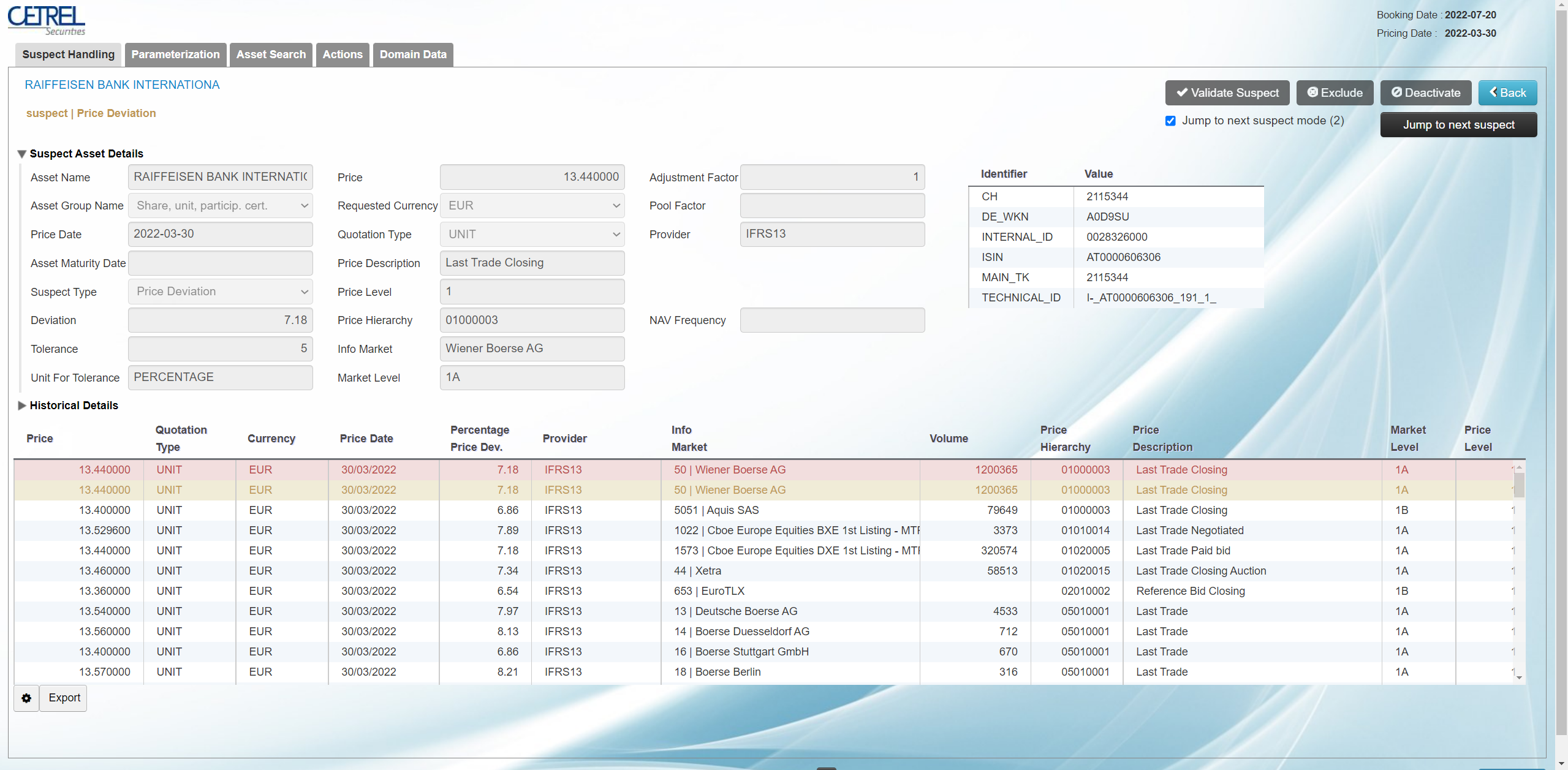

Validated pricing data are delivered into the appropriate output format to accounting / portfolio valuation systems. A detailed PDF with the underlying logic, how the fair value price has been assessed, which parameters and tolerances were set and how the security has been validated, leading to the selected price is delivered for archiving and auditing purposes. All prices in exception will need to be manually checked, validated and potentially corrected by the end users through a specific Graphical User Interface. Alternatively, the client may outsource the process of manual validation to Worldline Europe (via BPO).

Main Features

- Common rule set with integration of client specific control and validation points

- Continuous legal observatory to keep in line with changing regulations

- User community driven product

- Optimized for private banking and fund valuation purposes

- Full Audit trail per security per day

- Multi data vendor compatible with cross checks

Key Benefits

- Reduced Regulatory Risk and Total Cost of Ownership

- Reduced Volatility in Process and Technology

- Reduced Market Data spending and Project risks

- Increased Straight Through Processing (STP)

- Reduced Operational Risk through increased accuracy for trading, reconciliation, risk reporting, compliance and analytics

- Minimal Project Risk, Costs and Duration

Our Offer

- Worldline Europe as single point of contact

- User community driven product (user group)

- 24/7 Supervision and Monitoring

- Business Process Outsourcing facilities

Worldline Europe would be happy to provide you with additional information and a demonstration of our products and services.

For more information on this product or service please download the factsheet or contact our support line. Download Factsheet