Since 2009 Worldline Europe is serving customers all over the globe with its standardized product UCITS Check.

The UCITS directive provides rulings and guidelines for pre- and post-trade checks to be done by UCITS compliant investment funds in relation with instruments acquired for the fund’s underlying assets.

The aim of UCITS is to guarantee that the underlying portfolio constituents of a regulated fund are risk-transparent and liquid. In this context a pre-trade check has to be done to determine whether or not an instrument is eligible according to the provisions of the UCITS directive and the CESR guidelines

Product Description

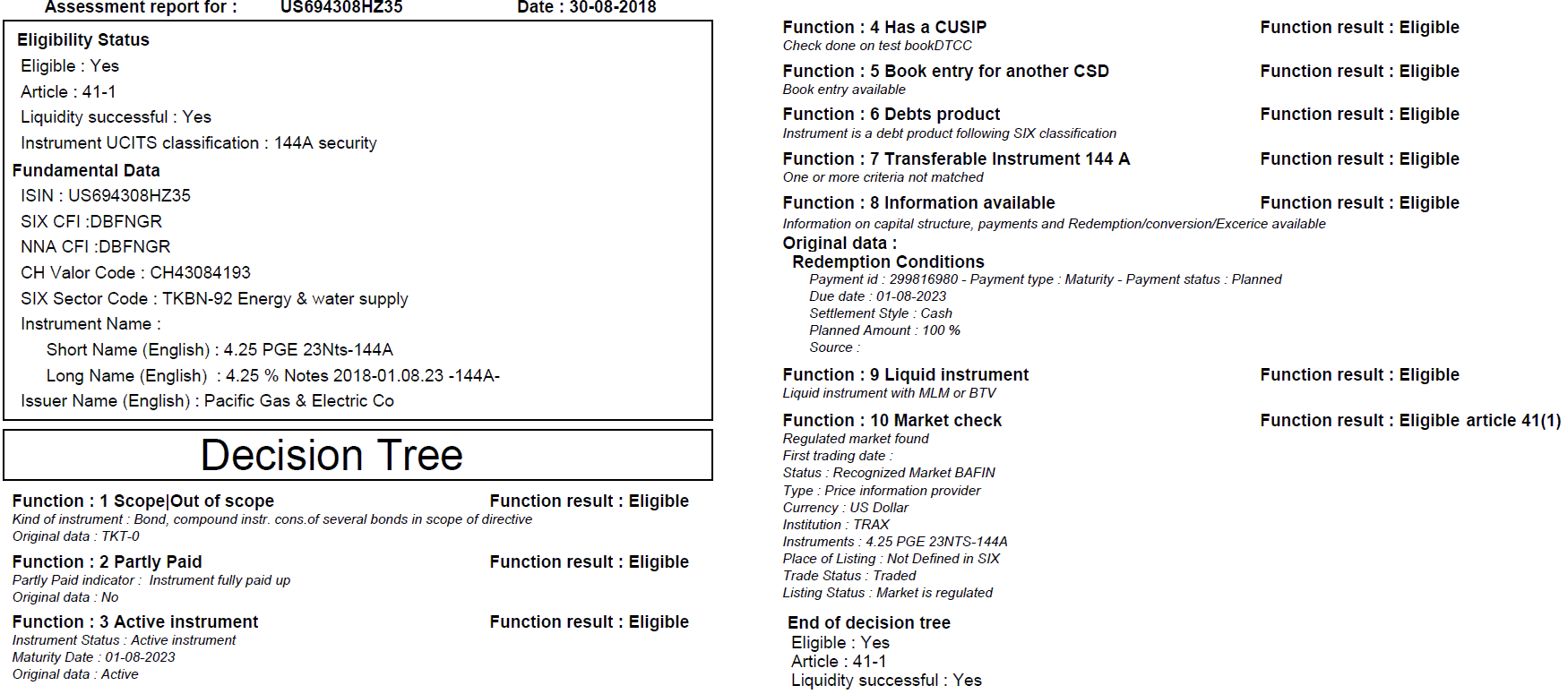

Worldline Europe has developed a specific set of rules mapping the UCITS eligibility assessment decision trees to the SIX Financial Information VDF data feed. The client generates an ad-hoc request originated by the trading or compliance environment, which is sent to Worldline Europe. SIX data sets are acquired and cycled through the UCITS Check application and an eligibility flag is calculated and returned to the client environment allowing solving the pending order.

In addition to a technical flag (eligible article 41-1, eligible article 41-2, liquidity monitoring - article 37 - ), structured information for further back-office usage and reports in PDF format are sent back to the client.

Based on the VDF data, the UCITS Check solution is able to provide a clear eligibility assessment for more than 90% of all requested financial instruments thus considerably easing up the compliance work of our customers in a challenging and highly time critical process. The UCITS Check service is used in various jurisdictions including Benelux Countries, Ireland, France, Baltic States, United-States, Singapore, Switzerland and the Nordics.

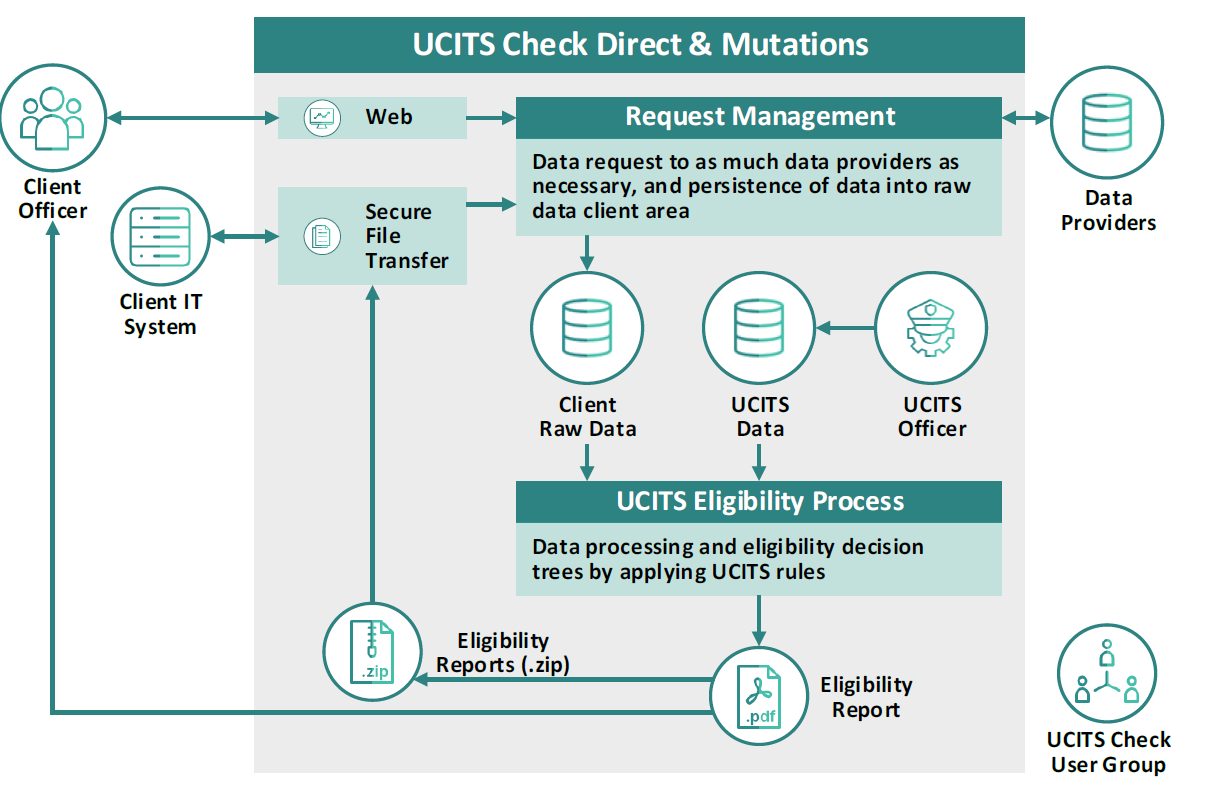

UCITS Check Direct / Mutations

With UCITS Check Direct, the eligibility of individual instruments is checked, from a 33 million instruments database updated every 15 minutes. The client has an online access through a Graphical User Interface, and can log intraday ad-hoc requests. A detailed PDF report (eligibility per instrument) is made available to the client. UCITS Check Mutations provides daily eligibility check based on the client’s instrument portfolio and a detailed PDF report and technical feed (eligibility per instrument).

Key Benefits

- Reduced Regulatory Risk & Total Cost of Ownership

- Reduced Volatility in Process and Technology

- Reduced Market Data spending and Project risks

- Improved Data Quality

- Increased Straight Through Processing (STP)

- Reduced Operational Risk through increased accuracy for trading, reconciliation, risk reporting, compliance and analytics

- Minimal Project Risk, Costs and Duration

Our Offer

- Worldline Europe as single point of contact

- User community driven product (user group)

- 24/7 Supervision and Monitoring

- Business Process Outsourcing facilities

Worldline Europe would be happy to provide you with additional information and a demonstration of our products and services.

For more information on this product or service please download the factsheet or contact our support line. Download Factsheet